Mastering cash flow: 5 expert tips to improve financial forecasting

Cash flow forecasting is the foundation of financial health and stability for any organization, but it holds particular importance for professional services firms.

With revenue models often rooted in project-based work, the ability to predict cash inflows and outflows accurately can be the difference between seamless operations and financial disruptions.

Yet, many organizations still struggle with inaccuracies in their forecasting processes. These inefficiencies can potentially lead to cash liquidity crises, missed investment opportunities, and unnecessary financial stress.

Fortunately, by adopting the right strategies and tools, professional services firms can refine their forecasting methods, unlocking greater agility and financial clarity.

Below, we’ll explore five best practices for cash flow forecasting, providing actionable tips to help you ensure robust financial planning and sustained success.

Explore the power of FP&A in minutes

Watch short demos that match your Financial Planning & Analysis priorities – whenever it fits into your schedule.

Understanding cash flow forecasting

What is cash flow forecasting?

Cash flow forecasting is a financial planning technique used to estimate an organization’s cash inflows and outflows over a specified time frame. It helps maintain liquidity, plan resource allocation strategically, and ensure financial solvency.

For professional services firms, cash flow forecasting is a crucial mechanism for ensuring the smooth delivery of projects, meeting client obligations, and managing operational costs effectively.

Why is this important?

Consider this example. A consulting firm relying on project-based revenue streams needs accurate cash flow predictions to ensure it can pay salaries, invest in marketing, and procure tools for upcoming projects. Delays in payments from one client or unexpected project costs can ripple across the organization, causing instability that could have been mitigated with accurate forecasting.

It is important to note that over 80% of small businesses fail due to poor cash flow management. This underscores the need for a reliable cash flow forecasting process, which is essential for long-term success and potential growth into a medium or large business. [Source: Agicap, The 2024 State of Cash Flow Challenges in Mid-Market Companies]

Tip 1 - Leverage technology for automation and accuracy

The era of complex spreadsheets for cash flow planning is coming to an end, although 44% of organizations still rely on Excel for cash flow monitoring. [The State of the Back Office 2025, Unit4 & Vanson Bourne]

Spreadsheets are prone to errors, lack scalability, and often create version control issues, resulting in inconsistencies across departments.

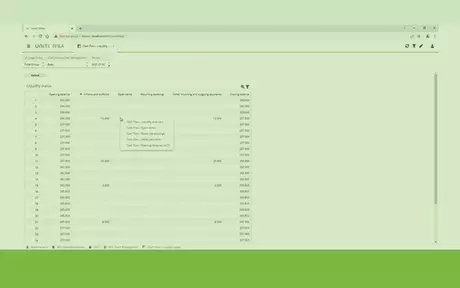

Instead, professional services firms should turn to modern Financial Planning and Analysis (FP&A) tools. These advanced solutions integrate seamlessly with enterprise Resource Planning (ERP) systems to bring automation and accuracy to your cash flow forecasting process. Such tools provide:

-

A unified single source of truth for financial data

-

Direct and indirect cash flow forecasting capabilities

-

Greater insights for informed decision-making

Platforms like Unit4 FP&A provide tailored functionalities for professional services firms, enabling precise and automated projections that save time and reduce errors.

Tip 2 - Collaborate across departments

Forecasting should never exist in a silo. To accurately reflect all business activities, collaboration across departments is essential. Teams such as sales, marketing, operations, and finance provide crucial data that shapes the broader financial picture.

Practical approaches to foster collaboration include:

-

Regularly scheduled forecasting meetings to align on key metrics such as upcoming contracts, operational costs, and marketing campaigns.

-

Centralized forecasting tools where multiple departments can input data, ensuring consistency and accuracy.

By uniting your team’s expertise, you create forecasts that are comprehensive and reflective of real-world business conditions.

Tip 3 - Monitor Key Performance Indicators (KPIs)

Tracking the right KPIs is crucial for understanding your cash flow position and identifying where corrective actions may be necessary. Essential KPIs for forecasting in professional services include:

-

Operating cash flow: Tracks cash generated from core business operations.

-

Days Sales Outstanding (DSO): Measures the average number of days it takes for receivables to be converted into cash.

-

Days Payable Outstanding (DPO): Assesses how long your organization takes to pay its bills.

Monitoring these KPIs enables businesses to identify trends, understand their cash positions, and adjust operations proactively to mitigate potential roadblocks.

Tip 4 - Regularly review and adjust forecasts

The dynamic nature of the business world demands that cash flow forecasts evolve continuously. Relying on static forecasts can leave your organization vulnerable to external disruptions, changing market demands, and internal shifts.

By adopting rolling forecasts, your finance specialists can regularly update cash flow predictions to reflect the latest available data, providing your company with agility and resilience. For example:

If global trade becomes volatile due to unexpected tariffs, a professional services firm that relies on international procurement may need to revise its costs, renegotiate contracts, or adjust pricing.

Regular reviews ensure your financial predictions stay aligned with your current business environment.

Tip 5 - Focus on both direct and indirect cash flows

Cash flow forecasting isn’t one-size-fits-all. Implementing both direct and indirect cash flow forecasting methods is crucial for a comprehensive view of your financial health:

- Direct method: Short-term, transaction-specific predictions that focus on near-future inflows and outflows.

- Indirect method: Long-term cash flow predictions derived from aggregate financial statements, enabling strategic planning.

Utilizing an FP&A platform that integrates diverse data sources facilitates the management of both types of forecasts, providing a comprehensive financial perspective.

How can Unit4 help your organization master cash flow?

Mastering cash flow forecasting is a strategic advantage that helps professional services firms achieve financial stability, operational efficiency, and future growth.

By leveraging technology, fostering collaboration, monitoring KPIs, and keeping forecasts dynamic, you can transform cash flow management from a challenge into an enabler of success.

Want to elevate your forecasting game? Explore Unit4 FP&A tools to automate and optimize your cash flow planning. You can also watch a demo or speak with our sales team today to discover how our solutions can help your organization achieve greater financial clarity and stability.