National Insurance Changes: What UK employers need to know in 2025 and how FP&A software can help

The recent impact of political changes to the National Insurance Tax for employers, as announced in the 2024 Budget, will impact many employers across the UK, this year and beyond.

The impact shouldn’t be understated as the changes are significant, requiring agile financial planning and forecasting to ensure the changes don’t negatively affect your organization.

Financial Planning and Analysis tools could provide a solution for organizations, with capabilities to model the impact of National Insurance increase, coupled with an ability to plan finances effectively.

In this blog we are going to discuss the changes, why they are significant, the kind of impact it will have on various organizations, and how Unit4’s FP&A solution can help you manage the change effectively.

How is National Insurance changing for employers?

Employers in the UK are facing significant changes to National Insurance Contributions (NICs), which are set to increase beginning April 2025.

The standard rate of employer NICs will rise from 13.8% to 15%, representing a 1.2% increase. This adjustment applies to Class 1 NICs on employee earnings, as well as Class 1A (benefits in kind) and Class 1B (PAYE settlement agreements) contributions.

In addition to the rate hike, the secondary threshold—the earnings level above which employers start paying NICs—will be reduced from £9,100 per year (£175 per week) to £5,000 per year (£96 per week). This change significantly lowers the threshold for contributions, increasing costs for employers, particularly those with lower-paid staff.

What is the impact of National Insurance changes on organizations?

These combined measures are expected to raise NIC liabilities substantially, with government estimates projecting an additional £25 billion annually. Here’s how these changes could affect different types of organization:

- Large Enterprises - Larger employers cannot claim the Employment Allowance, meaning the full brunt of higher NIC liabilities will fall on them. Despite the headline 1% reduction in employer NIC rates, other measures — including expanded NIC bases, reduced exemptions, or alignment reforms — are projected to raise £25 billion annually.

- SMEs - Smaller businesses may benefit from an increase in the Employment Allowance, which will rise from £5,000 to £10,500 annually, allowing eligible employers to offset NIC liabilities.

- Low wage organizations - These changes will disproportionately impact industries with lower wages, such as retail, hospitality, and care, where NIC increases could be as high as 50% for some employees.

- Higher wage organizations - Organizations in higher-paid sectors may see smaller percentage increases, but uncapped employer NIC contributions in the UK mean significant costs for high earners compared to capped systems in other countries.

- Higher Education Institutions - NIC changes offer temporary payroll relief for universities, slightly easing expenses. However, the changes fail to address deeper issues like stagnant grant funding and tuition fee caps. While job cuts may slow, restructuring and outsourcing will continue, and long-term financial stability remains a challenge.

- Nonprofit Organizations - Nonprofits gain some payroll savings from lower NIC rates, helping retain some frontline workers. However, reduced donations, stagnant grants, lower central government funding, and rising service demands limit the impact. Layoffs may slow but won’t stop. Better use of funding remains essential as funding has not changed to match inflation changes.

Click to read FP&A product brochure gated

How will National Insurance changes for employers affect pension schemes?

The upcoming changes to employer National Insurance Contributions (NICs) could also have implications for pension schemes, particularly defined benefit (DB) pensions, where employer contributions are based on employee earnings. As NIC costs rise employers may face tighter budgets for other employee benefits, including pensions.

Some organizations may choose to offset higher NIC expenses by reassessing their pension contributions, potentially reducing contributions to defined contribution (DC) schemes, or even renegotiating the terms of DB schemes.

For defined benefit schemes, where benefits are guaranteed, additional NIC costs could indirectly increase the strain on funding obligations, potentially leading to greater scrutiny of these arrangements.

Moreover, increased employment costs for organizations will naturally affect employees through lower compensation growth, with individual pension savings likely being affected. Employees receiving smaller pay raises might contribute less to their personal pension schemes, which could impact long-term retirement savings.

This heightened sensitivity underscores the need for businesses to carefully evaluate how to balance rising NIC costs with maintaining competitive and fair compensation and benefits packages, including pension offerings.

How can Unit4 FP&A help organizations prepare for changes to National Insurance for employers?

Employers will ultimately have to allocate more resources to ensure tax compliance with these changes to NIC contributions. This will have a large effect on other financial processes such as budgets, overall costs, staff allocation, compensation, and notably – pensions.

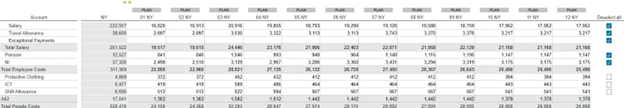

Unit4 FP&A provides organizations the capabilities they need to manage these changes before they occur with forecasts, allowing them to plan finances in advance and make employees aware of how these changes may affect them, and to understand how these changes will affect financial health.

Unit4’s Payroll capabilities provide an updated contribution calculation with the new rate and threshold, to ensure compliance. These recent changes aim to balance increased NIC rates and thresholds with support for employers through a more generous Employment Allowance – in Unit4 Payroll employers can change this manually.

With the ability to easily change drivers and values in the software, this allows financial teams to get an idea of how these changes will affect budgets and other overall costs, or even more in-depth forecasts to understand its effect on pension and employees.

To learn more about Unit4 FP&A, visit our dedicated webpage, or talk to sales today!